Rich vs. Poor is a powerful dichotomy. It has been used by politicians and master manipulators to create conflicts and punish countless people. The reality is there are many different levels to the money game on your journey to achieving financial freedom.

Think of it this way: if you are interested in becoming an expert in karate, you first start out as white belt, then yellow, orange, green, blue, brown and finally black. Each level has its own challenges and barriers, as well as skills one must learn and apply in order to progress to the next. You can’t go from a novice white belt to an expert black belt without going THROUGH the other levels. Your financial condition is no different. But to start, you MUST know which financial level you are currently in so you can map out the steps required to get to the next level up with the Econologics Roadmap Financial Plan.

The road to financial independence is open to those who completely recognize where they are, compared to where they are headed.

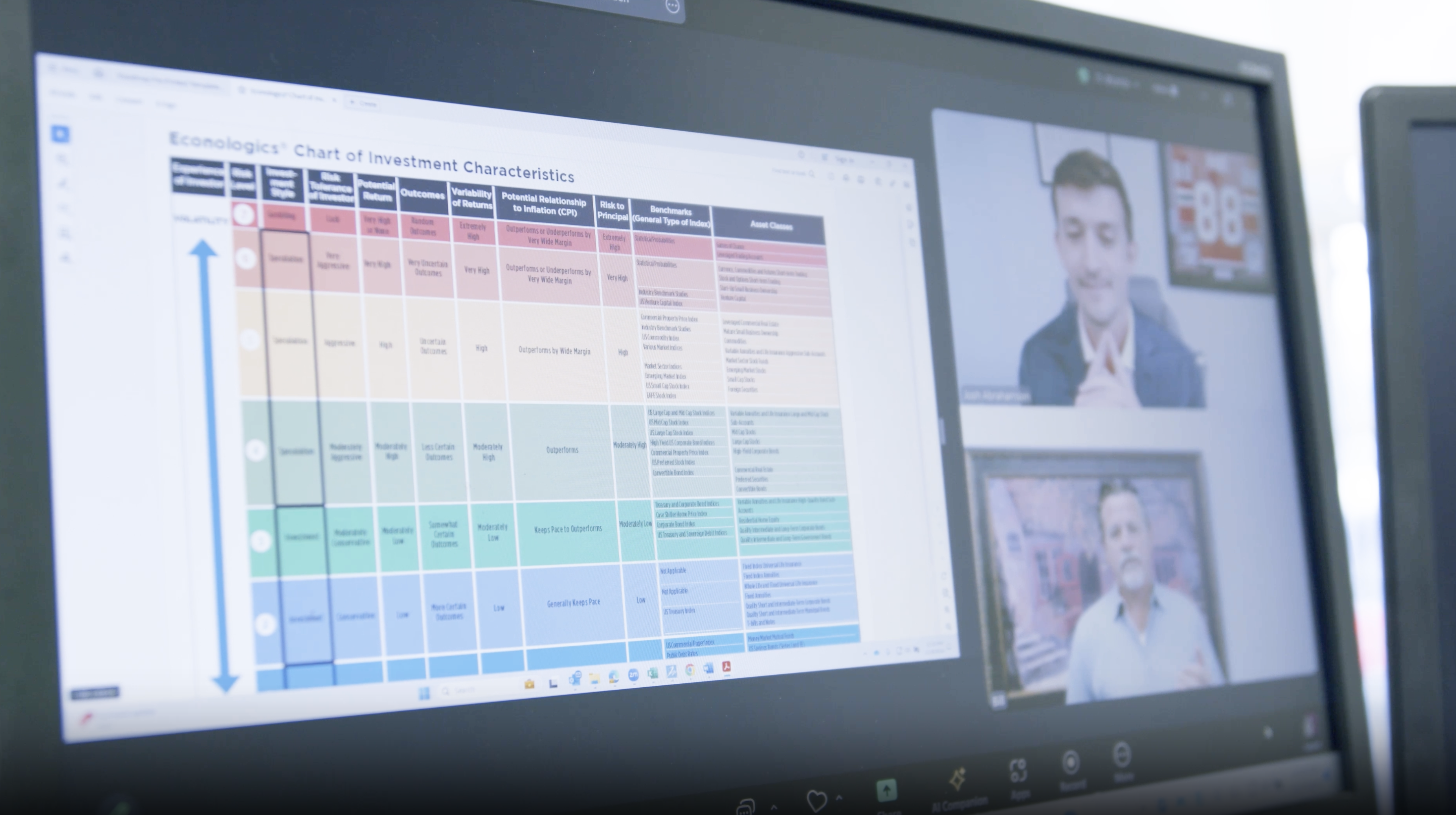

There are 7 Zones of Financial Freedom. I created a chart to illustrate each financial zone based on common measurable characteristics to easily plot yourself on the chart and find your zone and then look to the levels above your zone to better target and plan activities to improve your financial condition one zone at a time.

In this article, I will first explain some of the elements that are apparent in every zone of this financial freedom chart so you can begin to understand the characteristics that you will use to identify your relationship in proximity to each zone on your journey to achieving financial freedom.

Personal Income

This element measures the amount of personal income typically made by an individual or household in each zone. The income can come from many different sources. The 3 primary sources of income are Earned Income, Passive income, and Investment Income.

Net Worth

The net worth of an individual is measured simply by: 1) the combined value of one’s assets (typically including business value, real estate values, and investment account(s) value) and 2) minus the liabilities (debts) one owes. It’s a fairly simple calculation and, while you will hear most “gurus” clamor about net worth, let me assure you, I have met many people who had a high net worth but very low income, and vice versa. Your proximity to financial freedom is not based on one characteristic alone, however, aside from extreme instances, one’s net worth is a useful calculation to help pinpoint a relative financial zone.

Consumer Debt VS Income Producing Debt

There are two types of debt one can have. The first type is consumer debt, (aka: bad debt), which is debt that doesn’t produce a cashflow and appreciate in value simultaneously. Examples can include: primary residence, second home, credit cards and vehicle loans. Although assets with debt, like your home, may appreciate in value but don’t produce cashflow then are still considered consumer debt. The second type of debt is cashflow producing debt. This is debt used to purchase an asset which will provide cashflow, as well as increase in value over time. Examples are business ownership, commercial real estate, multi-family rental units, etc. Types of debt are an important aspect relative to your overall economic experience. Learning how to structure this requires guidance on investment strategies for practice owners.

Types of Income Streams

It isn’t breaking news that having multiple income streams is ideal and important for one to achieve continued financial independence and level up the financial ladder. However, most individuals attempt to achieve this result with impatient speculation and have the reverse affect. That being said, as one moves up the financial zones, the opportunity to build multiple types of stable income streams increases. A great first step is taking the Financial Prosperity Index® assessment to see where you currently stand.

Financial Experience

This element is a word that describes the overall state of one’s financial affairs and relatively defines the condition of a person or a household in that financial zone. It’s meant to indicate the financial experience one might encounter as a result of how well or poor the household is operating, including the appearance, quality of life and working order of household finances.

Number of American Households in this Range

Where do you stand compared to the economy you live in? It’s important to evaluate your financial condition against the number of people who are statistically in that same condition. This is simple to measure utilizing IRS statistics.

Average Tax Rate

When you understand statistically the average tax rate one generally can expect to pay as a percentage of their total income, then one can begin to strategize a retirement and tax strategy to pay the least amount of taxes possible.

As a word of ca ution, none of these financial zones and associated numbers are absolutes. There will be statistical outliers. This chart was developed based the financial data I’ve collected from 350 business owner households, deductive calculations based on income from business earnings, the most up-to-date published IRS statistics, and based on my observations of the productivity of individuals ranging from the super-wealthy, to the impoverished, and everything in-between.

I’ve taken the time to summarize the identity of each zone to help give you some markers to consider for each one I’ve outlined in this chart.

Zone 0: Trapped

Aside from those born into wealth, Zone 0 is where everyone starts. Unfortunately, too many people remain in this condition. In this zone, the income of the majority is in a range from $0–$75,000. Almost 100% of their income is Earned Income. If you are a business owner, most of your staff probably resides here. People in this zone typically have a negative net worth. This means they generally don’t own many assets or have much in liquid assets. Almost all the debt in this zone is consumer debt. The only income stream is the wage they earn at their job or by governmental assistance. The average income tax rate for households in this zone is 0%.

The financial condition in this zone is “trapped.” Trapped in a job that doesn’t pay the bills, trapped by creditors, trapped in a house they can’t move from, and trapped in a negative mindset where they have given up on achieving any kind of financial success. The most depressing aspect of this zone is the sheer number of people that sit in this zone. Of the approximately 164,000,000 American households, 72% or 118,000,000 are stuck in this zone. There is a way out of this zone. The first step is your recognition that you are in this zone and being stuck here is not inevitable, desirable, virtuous, or permanent and the second step is scheduling a Wealth Building Strategy Session to start moving forward.

Zone 1: Scarcity

When you graduate from being financially trapped, you will move up to Zone 1. Most people in this zone are making between $75,000–$200,000. While this seems like a large income range, the overall condition for most households is not strikingly different. If you are a business owner, some of your best technical employees, executives and associates will be in this range. A lot of solo entrepreneurs who have two employees or less are in this range. These are typically people who have some type of technical or college training. The net worth of people in this zone is anywhere between $0–$1,000,000. Almost all the debt that people have in this range is still consumer debt. The cars may be nicer, the houses may be bigger, but the type of debt is still the same. There is also a much higher amount of student debt.

Most people in this zone are still reliant on one income stream which comes in the form of wage earnings from their duties as an employee. The operative word that best describes the attitude of this zone is “scarcity.” There is never enough and every financial decision is made with the mindset of “either/or.” The either/or mindset is the indicator that proves a scarcity of money exists. As a financial advisor, it is here where I field questions such as, “Should I pay off debt OR put money in savings?” “Should I pay for college OR put money into retirement?” “Should I put money in my 401k OR build up my emergency fund?” This is symptomatic of a scarcity condition because you should be able to do BOTH. The average tax rate is generally between 2-6%, and the number of households who are in this range is 22% of the population. In reality, with the right budgeting strategies like the 60-30-10 approach, you can do both.

If you are doing the math, 94% (154,00,000) of ALL American Households are in Zone 0 or Zone 1.

Zone 2: Insecure

As one begins to climb the financial ladder, they can expect to hit a zone which looks pretty appealing to most people. This is because Zone 2 is one that only about 7,600,000 households enjoy and where the personal income ranges between $200,000 and $500,000. This zone is where one could observe a lot of successful professionals, private practice owners, skilled sales people, executives and small business owners with between 5–10 employees. About 80% of the debt that people carry in this zone is still consumer debt, because as people improve their condition there is a tendency to acquire a better “quality” of this bad debt. However, 20% of the debt for those in this zone is income producing (good) debt, which includes purchasing smaller rental units, smaller commercial buildings or business acquisition loans (buying existing small businesses). The net worth of people in this zone ranges between one million and three million, typically from savings and retirement investments, home ownership, business ownership, and real estate ownership.

It is in this zone where you see an individual begin to slowly create additional income streams or have the desire to create multiple cash flows. Even though the financial condition is much better in Zone 2, the condition is still considered to be “insecure.” This is why Zone 2 practice owners benefit from working with an industry-specific financial advisor who understands both household and practice dynamics. Therefore, there is still a large dependency on the main money artery, which is typically their primary business. The majority of people in this zone is still operate in scarcity because the tend to spend exactly what they make and have very little in liquidity.

Zone 3: Content

Here we have the zone that is considered the most dangerous of them all: Zone 3. This may seem a bit contradictory because the income level for most people in this zone is between $500,000 and $1,000,000. This IS the 1%; known as the most vilified group in America because they seem to “have it all,” but only do so on the backs of the little guy. Of course, this is not true; they work hard for their wealth! The people in this zone tend to pay the highest percent of their income to taxes. One of the more unfortunate qualities of this group is they tend to rely on the advice of the traditional financial advisor or accountant. This puts the people in this zone in jeopardy because that common advice instructs them to “buy a big home, put money into your 401k, buy stocks, buy term insurance and invest the difference and don’t mess with the IRS.” The people in this zone are very susceptible to the opinions of those who reside in a lower zone, and it is those “lower zone” people who cannot relate to challenges or opportunities people in this Zone 3 face.

The word that best describes the condition of people in this zone is “contentment.” However, many in this zone follow the advice of a traditional financial advisor. This is dangerous because unlike an industry-specific financial advisor, traditional models don’t account for practice owner realities. Because of the extreme hard work it took to get to into this zone, most people stop pushing at this point. Because most of their friends are in the zone below them, people in Zone 3 tend to start to relax and enjoy the good life. They buy bigger homes, second homes and more “stuff.” Their debt ratio is usually 50% consumer debt and 50% cashflow producing debt. This is the zone that most traditional financial advisors will proclaim their clients are “financially secure.” This is false. With a net worth of between three million and six million, the people in this zone cannot afford to make a mistake with their investments, their practice or their health. One bad move and they are right down into a lower zone again.

Zone 4 and 5: Expansion and Abundance

Zones 4 and 5 are where true financial freedom begins. This is where one can really start to see individuals creating an abundance of income. While in Zone 4, the main money artery, the primary business, still provides the majority of the income; however, you do start to see significant income streams being built in other businesses, investment accounts, insurance products, alternatives and real estate. The business owner in this zone is generally not working as a technician of any kind and is acting primarily as a CEO to guide the expansion of the business. The business earnings are significant enough that the value is a multiple of anywhere between 6–12 times EBITDA (earnings before interest, tax, depreciation and amortization).

As the business owner expands their empire, the income and net worth accelerate at a rapid pace.

This is where the Econologics Roadmap Financial Plan provides advanced strategy for scaling wealth.

The quality of their “opportunities” are the best of the best. This is because the person in zone 4 or 5 has situated themselves in a position where they attract more viable possibilities to grow. People in these zones are considered “lucky” or have “all the right connections.” The truth is, they are presented with an abundance of fruitful opportunities because they are being rewarded for helping so many people (through their services and employment of the community). With a net worth of over twenty million, they can afford to take a calculated risk or make a financial mistake and not fall into a lower condition. It is in these 2 zones where you see one’s net worth continue to rise exponentially. In fact, there are so many income streams for people in these zones that they will never need to be concerned about financial insecurity.

Zone 6 and 7: Power and Indestructible Wealth

There are probably less than 66,000 people in America who will ever get to enjoy these 2 zones. Within these zones you will find two types of people. The first type consists of individuals who create a huge value to their customers through their legitimate business activity. The second type is a faction who tries to collect as much wealth as possible at your expense. They believe in the zero-sum gain, which means in order for them to win you have to lose. The majority of the people in this zone are the first type. They own the majority shares of their companies and have created multiple income streams in other ventures. They have attracted enough attention where their products and brands are extremely well known and utilized, and they have acquired this status fairly. This truly is financial power!

In this zone, people have so much wealth that nothing could endanger their financial survival regardless of what happens to the economy at large. Their wealth is indestructible. A telling statistic is the amount of tax individuals pay relative to their income in these zones. Typically, they will hire some kind of “family office” with a team of financial experts on their payroll. Partnering with our team of advisors ensures you’re structured correctly for legacy-level planning. In these rare cases they are able to set up multiple entities to defer or minimize their tax liabilities through the use of advanced tax strategies. Charitable foundations, 1031 exchanges, Captive Insurance Companies, and many other strategies are used by these people in these zones with no fear of being audited or harassed by the IRS.

They understand the value of money. People in this zone are typically philanthropic. It is commonplace for them to donate an enormous sum of money to charities. They know their potential and will disagree with the status quo. They have taken ungodly risks and are not afraid to go to the financial brink. The most admirable quality of these people is their desire to want others to have wealth, too. For those who have achieved this zone under no unfair practices, one can observe them to be the ones who truly represent the best of mankind.

What’s next?

First, you must be very clear on what financial zone you are in and why to truly begin to understand your current financial condition and how you got there, and then decide which zone you want to achieve before you retire and sell your business. Don’t wait — book a Wealth Building Strategy Session now to see what’s possible. I encourage you to get a little uncomfortable and think big. Then look at the next financial zone above where you are currently. Determine what it will take to reach that next level and work with a financial advisor who specializes in working with business owners who can help you map out the steps you need to take NOW to achieve that next zone.

Getting into a financial condition of truly unlimited wealth does take time, but it doesn’t need to take a lifetime. BUT YOU MUST START ON A CLEAR PATH NOW! To get results fast, you need a plan of action and someone who understands how to pull your business and personal finances together for better control and management. You don’t want another year to pass by and you’ll be in the same boat with the financial challenges of inflation and staff eating your business profits and you struggling to pay yourself properly and manage your personal finances with progress toward paying off debt and building retirement savings all at the same time. Are you tired of being stressed out about money?

Financial planning is the action of taking small repetitive and boring steps in the beginning to get you in a financial position so you can pounce on real opportunities that will ultimately accelerate the wealth building results you want. You may not have control of the economy, but YOU DO HAVE CONTROL OVER YOUR ECONOMY! Believe it or not, you can determine how long it takes to achieve your financial goals, but it starts with your persistence, imagination and tenacity a decision to change your mindset, attitude and behavior. Then work out a short-term plan of action tied to measurable results and then adopt the discipline to action. Then commit to take each step, one at time, with the guidance of a professional who knows how to monitor your progress and help you through obstacles and challenges along your journey.

Believe it our not, planning is not labor intensive. Floundering is. The hard part is first deciding that change is necessary and admitting that you don’t know what you don’t know. Then trusting your ability to hire the right team to advise you, allowing someone else to direct you, doing what is necessary to get results and finally looking at your progress regularly. If you aren’t getting the results you want in your business or personal life, consider which of the highlighted words might be standing in your way of financial security. You are in control – you have to know what to control to get better results.

It’s really not hard – you just have to be willing to admit that you don’t know what you don’t know when it comes to personal and business finances and be willing to seek help from a qualified financial planner who understands your business. If you are not working with an industry specific financial advisor, then you are likely following the “Traditional Retirement Planning Model” and for you, that may find you stepping away from your practice without enough in income, assets and resources to live the retirement life you want live. This is the experience that one-half of one-percent of Americans are having follow traditional financial advice – but the good news is, this doesn’t have to be YOU! Because you own a professional private practice – you have a unique opportunity to utilize the business to build personal wealth and multiple streams of income in 10 years or less – just by changing how you manage your business and personal finances. We have a proven system, designed for practice owners in certain healthcare industries, that is designed

It’s what we do with all our clients at Econologics Financial Advisors. We understand how to help practice owners achieve financial freedom and their financial situation was no different than yours. We guided them and held them accountable to their goals through turbulent times and incredible opportunities and everything in-between. We can guide you too – but it’s up to you to decide to learn more. I encourage you to meet with a specialist and get a complimentary strategy session to see what might be possible with our help and then decide what’s next. Commit to yourself to take the next step to meet with Cody Goldstein, and he’ll walk you through a short consultation to identify areas of your business and personal finances that need immediate attention and you can get on track with the advice you need to feel secure and in control of your finances. Use this link to schedule directly on his calendar for the next available appointment.

Print off the Econologics® 7 Zones of Financial Freedom Chart and post it at home and in your office. Let it serve as a visual reminder to motivate and to keep you on track to becoming a Financial Beast®.