Introducing Econometry® Analytics: Results-Based Financial Metrics™ for Practice Owners

Comprehensive Metrics for a Practice Owner’s Financial Plan

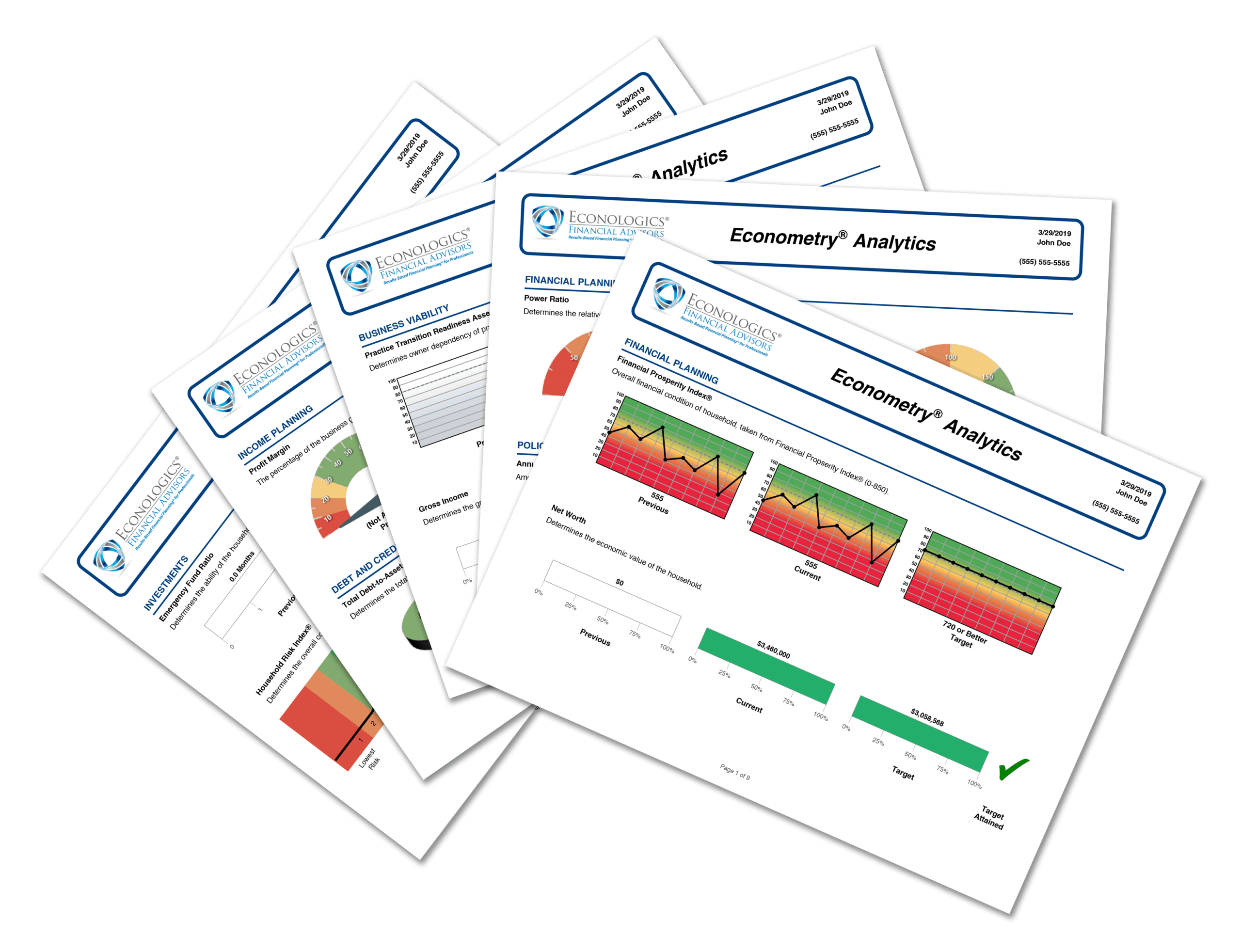

Using our breakthrough metrics technology, Econometry® Analytics, we assess your progress toward financial goals across 17 meaningful variables—so you get clarity about specific next steps to take through the planning process.

General Financial Plan Metrics

Financial Prosperity Index®: Overall financial condition of the Household compared to an Optimum Financial Condition. (Econometry proprietary metric)

Net Worth: Determines the economic value of the household.

Business Viability Metrics

Practice Transition Readiness Assessment®: Determines Owner dependency with the practice. (Econometry proprietary metric)

Practice Gross Income: Determines the gross income of the company

Profit Margin: The percentage of the business gross income accreting to the household.

Income Planning Metrics

Power Ratio: Determines the relative survival power of the Household in any economic environment. (Econometry proprietary metric)

Annual Reserves Allocation: The amount of gross income transferred to savings on an annual basis.

Value Gap*: The difference between what you have for assets and income versus what you need for future personal living expenses. (*Copyright term and metric used with permission from Pinnacle Equity Solution)

Debt & Credit Metrics

Housing Debt-to-Income Ratio: Determines the amount of monthly income committed to housing.

Household Total Debt-to-Income Ratio: Total amount of household income committed to servicing all debt.

Credit Score: Determines the credit worthiness of the household.

Estate Planning Metrics

Estate Plan Integrity: Determines to what degree the estate planning is complete and current. (Econometry proprietary metric)

Asset Protection Metrics

Asset Protection Ratio: The percentage of household assets that are considered generally protected from creditors. (Econometry proprietary metric)

Income Tax Metrics

Investment Metrics

Emergency Fund Ratio: Determines the ability of the household to handle financial emergencies.

Household Risk Index®: Determines the overall concentration of the risk of all assets in a household. (Econometry proprietary metric)

Results-Based Financial Planning®

Comprehensive financial planning can feel overwhelming and confusing. With Econologics, it’s simple to gain confidence and get proven results.

Step 1:

Discover

Meet with a specialist to review your assessment and help discover what needs to be done to improve your financial condition.

Step 2:

Get a simple, customized step-by-step plan from a trained, licensed advisor who specializes in working with practice owner households.

Step 3:

Advance

Continue your progress by getting constant, ongoing guidance and accountability from your advisor plus have your plan rewritten each year to update your results and goals.