By Eric S. Miller

2008 was definitely a wakeup call for many. It was the first time since the Great Depression that many people witnessed what could happen to major financial institutions in a matter of days. Lehman Brothers- Gone, Bear Sterns- Gone, Washington Mutual Bank- Gone. And if it weren’t for the backing of the American tax payers, AIG, Freddie and Fannie Mac, Bank of America, and a whole list of others would have gone down the tubes as well.

Here we are in 2023 and in the midst of another wave of bank failures. Silicon Valley Bank, Signature Bank, and Credit Suisse are just a few a of the large institutional banks which have been affected by a rise in interest rates and bank mismanagement.

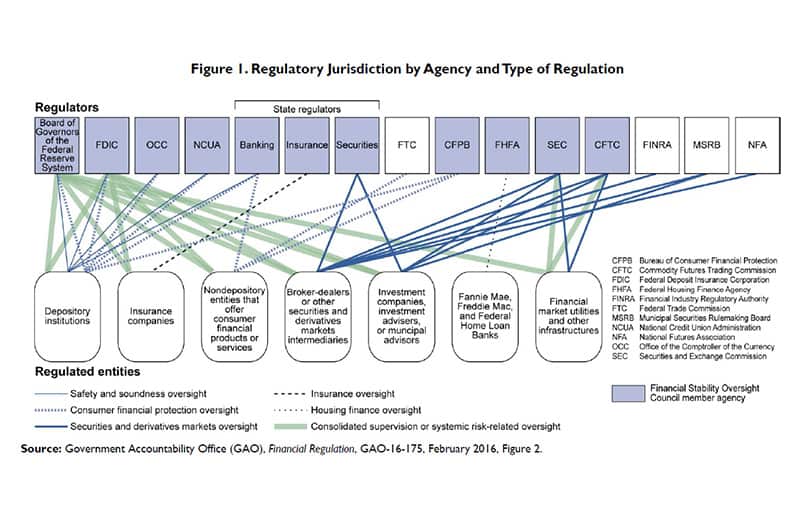

Our banking system and financial oversight system* is not stable. I pulled this chart from a Congressional Research Service to show just how convoluted and disorganized the oversight of our major financial institutions has become. (*See Chart of Financial Regulatory Oversight). If this was your business organizational chart, your employees and customers would have no idea who to follow, listen to, or go to for guidance. Yet this is the structure where Trillions of dollars of citizens money are being held and the oversight which accompanies it. All of your suspicion and anxiety about the safety of your money is warranted. The financial institutions you have been taught are “safe” is merely an illusion of worthless promises, overleverage, overspeculation, and susceptible to being torn down by the winds of mischance – and a lot of your wealth with it.

So, does that mean I am telling you to take all of your money out of the bank and bury it under your mattress? Of course not. Remember, my main objective is for you to simply be AWARE of where your money is held and how that financial institution operates. This analysis would include the types of financial institutions, the type of financial activity they engage in, the amount of leverage they utilize, the regulatory body overseeing them (good luck figuring this one out), their solvency risk, and how much risk these institutions are subject too from a seismic financial event. Again, this will be a general overview and there will of course be some exceptions to these characteristics.

There are 3 general types of Financial Institutions:

- Depository Institutions

- Investment and Securities Institutions

- Contractual Institutions

- Depository Institutions:

This type of entity basically is designed to legally accept and safeguard monetary deposits from the public. They act as a conduit for individuals and organizations to hold their money between various transactions their customers engage in. They have the ability to lend those deposits to individual and corporate buyers to spur economic activity.

Example of these types of institutions include Commercial Banks, Saving and Loans, and Credit Unions. Each of these institutions is established by a Charter. That means that in order to legally operate they must abide by the rules of the regulatory body which oversees them. Most of these organizations have both state and federal oversight. The main federal bodies which oversee these types of institutions are The Board of Governors of the Federal Reserve, the FDIC, The Office of the Comptroller of the Currency (OCC), the National Credit Union Administration (NCUA), and Bureau of Consumer Financial Protection (CFPB).

These organizations are in the business of lending. Therefore, they are subject to many risks. The predominant risks would be:

Risk of a system failure. The worldwide banking network is completely interconnected. What happens overseas can have an effect on the member banks of this country

Interest rate risk. The “price” of loans or its interest rates can fluctuate which can certainly have a negative impact on a bank’s balance sheet.

Credit or default risk. Let’s face it, if these lenders lend too much money to people who cannot pay back the loans, it can cause a massive amount of instability for these institutions.

Fraud or operational risk. Cyber-attacks and now becoming a main source of loss for financial institutions. It doesn’t take much for hackers to get access to millions of accounts and cause unlimited havoc.

Mismanagement of assets and liabilities. You would like to think that large banks wouldn’t be susceptible to incompetency on how they managed their portfolio of assets. You would like to believe they hire the smartest analysts who manage the risk of the bank’s assets and liabilities and hedge against certain financial risks in the market. You would like to think….

My 2 Cents:

Banks are promoted as “safe” financial vehicles for you to position your money. From 2008- 2012 there we 465 banks which failed according to the FDIC records. Compare that number with the other types of financial institutions and you can see that banks should simply be utilized to store a small amount of liquidity and should never be looked at as a “safe haven” for your investments.

- Investment and Securities Institutions

These are entities that are primarily in the business of securities trading and providing investment and wealth management services to the public at large. These include:

Brokerage Firms. These are companies which are in the business of connecting buyers and sellers of securities. There are full service and discount brokerage firms and they offer a vast array of services, but they mainly operate on trading and creating commissions. TD Ameritrade, E Trade, Schwab, Fidelity, and Merrill Lynch would all be example of brokerage firms.

Investment Companies. These are companies which will pool investor money together and invest it based upon a particular strategy. The most popular example of an investment company would be a Mutual fund company such as Vanguard or Fidelity Mutual Funds.

Most brokerage and investment institutions are regulated by the Securities and Exchange Commission. There are other companies which are considered self-regulating bodies which are formed to assist in making sure there is sufficient oversight. FINRA, (Financial Industry Regulatory Authority), is a body which will write and enforce rules for brokers and dealers to ensure compliance.

While these types of institutions are by and large safer than banks in terms of company failure, that doesn’t mean they are riskless. Bad management can cause any brokerage or investment firm to go belly up. In addition, the sheer number of brokerage and investment companies make it almost impossible for the SEC to be able to oversee all these types of companies.

There is a type of investor “insurance” if a brokerage firm goes bust. It is called SIPC (Securities Investor Protection Corporation). If you have an account with a brokerage firm that goes insolvent, then this MAY help recover some of your account if the firm gets liquidated. There are limits to the protection ($500,000 and $250,000 for cash) and it only applies to the CUSTODY function of the brokerage firm- NOT the investments. If you were sold a bunch of garbage investments and they are now worthless, the SIPC won’t cover it. If you owned a stock for 30 years and the company (not the brokerage firm) went belly up- sorry about your luck. The SIPC won’t cover it. FDIC and SIPC are 2 totally different protections, you must know them or you will think you are protected when you are not.

My 2 cents:

Many of you have your retirement accounts positioned in these types of financial companies. While I have more faith in the ability of these companies to stay solvent, on a company level, I still have concerns that a majority of business owners have too much of their reserves and investment savings held with these firms without understanding the potential risk that individual accounts can go down massively in value due of the relative performance of the underlying securities.

- Contractual Institutions

These are institutions which will acquire money on a contractual basis. In other words, there is a legal agreement which binds the 2 parties involved. The contractual institution will invest the money in such a way that they can meet whatever obligation they are required to base upon the contract. Examples of these entities would be life insurance companies, fire and casualty insurance, and state and government pension plans.

Life insurance companies have been in existence, in some form, since ancient Rome and most recently in the early 18 century. They create products that will provide a death benefit for families through life insurance contracts or can also provide guaranteed income for life through annuity contracts. Unlike banks, life insurance companies are not allowed to extend loans that are not backed by actual reserves. Life insurers are not regulated by the federal government, they are run by each state. There is a National Association of Insurance Commissioners who does set standards and regulations which are adopted by the states. Each state also has a state guaranty fund designed to make whole policy holders who are part of an insurer who is going insolvent. The limits are generally 250-300k. The NAIC does not allow insurers to market this state guaranty fund so it remains largely unknown to most policyholders.

In addition, insurance companies must keep a hefty amount of statutory reserves in cash to be able to pay for certain obligations. This doesn’t allow them to maximize the yield on the cash but it does mean during times of distress, life insurance companies have historically been very sound.

My 2 Cents:

In the battle of which institution provides the most stability, I would say that the life insurance and annuity industry wins hands down. They don’t operate on huge amounts of leverage, like banks do, and the value of the money inside of these policies is generally invested very conservatively to minimize loss of value (unlike investment and brokerage firms). They have enormous reserves and have historically not had near the rate of insolvency failure as banks have experienced.

In Summary

Most healthcare practice owners believe banks are a safe place to store money. In my opinion, you should only carry enough in your bank accounts to conduct normal business and personal transactions. All other assets should be positioned outside the banking institutions to reduce your risk. We live in a different time than 50 years ago, make sure you are protecting your family and business from a fragile financial system.

Navigating the financial landscape can be a daunting task. Especially when there are complexities in understanding where your money is safest. Unfortunately, it seems we often don’t examine this topic until an economic crisis threatens our survival (about every 10 years or so). Uncertainty can cause all kinds of missteps and mistakes. The best way to protect your wealth is to work with a financial guide who understands your business is your largest investment asset and can help you know how to maximize the value of your practice to build wealth. If your financial team isn’t working alongside you and helping guide you on your financial journey, then it might be time to find a team who can do the job.

With the Econologics® Results-Based Financial Planning® System, all of that uncertainty goes away. You’ll have a strategic plan, a roadmap, to know exactly where you are going and how to get there. The secret sauce is the expert guidance and objective measurements of the system to track your progress along the way so you can avoid financial pitfalls and mistakes and feel fully in control of your financial future. EVERY practice owner needs a financial advisor who understands how important their business is to their household, stands by them when times get tough, holds them accountable, and guides them through times like the current. This isn’t a journey you should travel alone. It is important to lean on us as your guide.

Get guidance and a plan built specifically for your needs so you can enjoy every phase of ownership while reaching your personal financial goals along the way. Visit our website resources page and download a free guide or financial checklist or call our office to schedule your free 30-minute consultation with an Econologics® Specialist to get your questions answered about this topic and more.

Disclosure: Econologics Financial Advisors, LLC (‘EFA’) is registered with the Securities and Exchange Commission as an investment advisor. (Such registration does not imply a certain level of skill or training.) This communication is not an offer to sell or effect any transaction in securities. Neither EFA nor its affiliates provide legal, tax or accounting advice. Please consult a qualified attorney or accountant.

Recent Comments